What follows is an attempt at an honest comparison between self-managing rental property vs hiring a property manager to do it for you. Of course, I’m a bit biased being in the business as a ‘professional’ but I’ve also self-managed rental homes in the past. I currently own an LLC with a small portfolio of homes managed by River Region Rental, so in a sense I still do ‘self-manage’ but from behind the firm.

What I would like to do is break down the various elements of the job and compare and contrast how each side approaches the task. Hopefully I can create a list of pro’s and con’s to let property owners properly evaluate how to approach managing a rental.

Now, you have to field calls and show the home (be prepared to get stood up on appointments, a LOT). Depending on the desirability of the home, this may be a slight workload, or a lot. A self manager may have an advantage here- you will be able to answer questions about the home immediately that a property manager may not. The lower the asking rent the more inquiries you will field, but the quality of the potential tenant pool may not be what you are looking for. At higher rents, there are less inquiries, but you may find the potential tenants more reliable.

End Result: A self-manager can do all a property manager can do, given enough effort. Only the individual can determine the value of their time, fuel, etc.

Vetting the Renter

Now you’ve found a potential tenant, but how do you know if they are going to pay rent and treat your home with care? Well, you don’t, at least not at first. A self-manager has some tools available- requiring proof of income, references, and checking past rental history (calling up the people that rented to the prospect in the past). The property manager has more, since in addition to those checks they also pull credit reports, search criminal history, and look for past evictions.

This is the great trap for a self-manager. You should consider hiring someone to do this for you. Our firm processes applications for self-managers all the time, and I’m sure our competitors do too. Even better, just hire them to do a lease-only contract for you (they market the home and provide a qualified tenant, then write the lease). Be aware that by law, the firm can not show details of the report to you, for example the credit report, but they can relate to you in general terms what they found.

One detail that distinguishes owner managers vs. property management firms is that a firm must rent to qualified applicants in a first-come basis. They can’t ‘cherry-pick’. If it’s important to you to pick tenants by appearances… well then you are on your own and you deserve what you get.

Now back to the yard sign thing I mentioned. You know what potential tenants with criminal records or evictions do? Well, after having their applications denied immediately a few times, they start to drive around looking for that FOR RENT sign from the hardware store. Self-managers rarely check for evictions for example. Don’t let that be you.

End Result: A professional property management firm will find you a better tenant 9.8 out of 10 times. Hire someone to lease the property for you. Or at least sign up for a lease-only contract or get someone to run the applications. Don’t risk an entire house to save a few bucks.

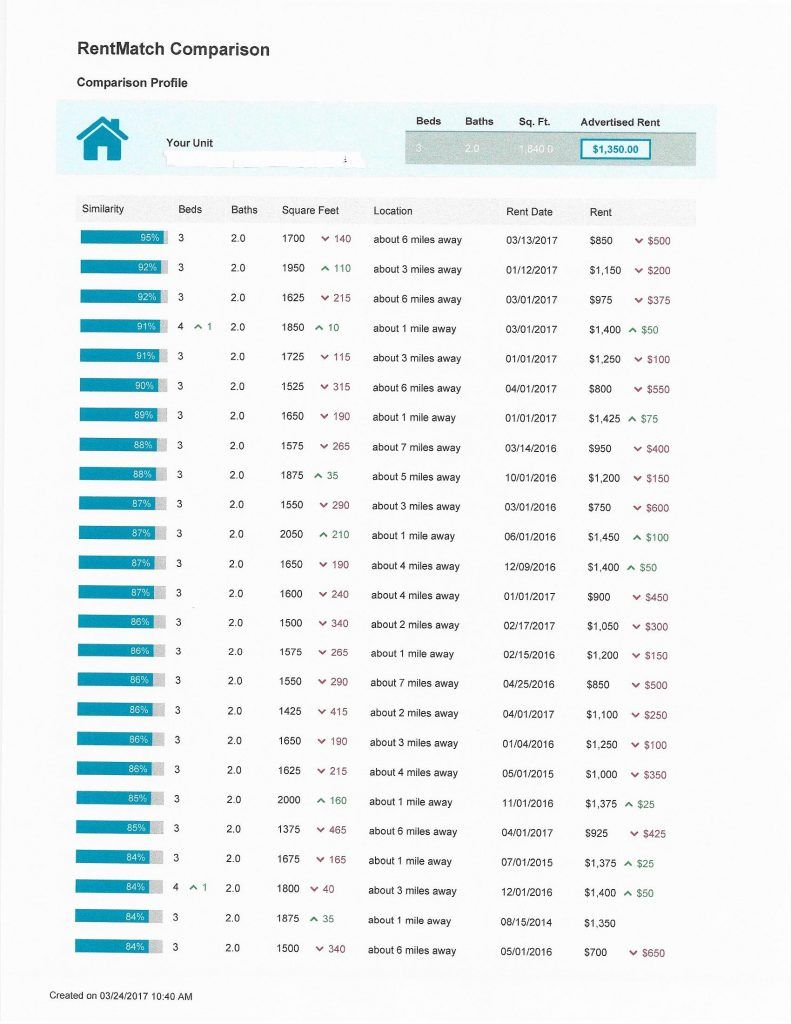

Setting the rent price accurately

There are 3 ways to do this: 1) Check the asking rents for similar properties to yours on a website like Zillow.com. Hopefully there are enough comparable rentals to get very close. 2) Rely on ‘experience’ to know what the market rents are for a given type house in a given neighborhood. 3) Use property management tools to determine the possible rent.

Self-managers are famous for doing #1, and many are very good at it. There is nothing wrong with this approach. And if your portfolio is very large, you might even have a feel for #2. But honestly, a firm with a reasonable portfolio is going to have #2 nailed, and if they have invested in good tools, #3 as well.

So how big a deal is this? Well it depends. For most situations, if you are going to err, it’s better to slightly under-price than over-price. The reason is vacancy loss. If you lose a months rent trying to get $850 when you could have rented right away for $750, you will eventually get your money back. But for higher rents, maybe not. The tipping point is near $1000 or letting a house sit for 45 days or so. In our market, if it’s sat that long without being rented, it’s either in an undesirable area, there are problems with the dwelling, or it’s over-priced.

An example of an in-house tool that we use to determine rent pricing. It also includes fancy bar graphs and maps, but I think you get the idea!

Conclusion: Property managers have the edge, but a savvy self-manager can compete if they put in the time and effort to do so.

LeasingIn our area, self-managers typically do a 1-page, month-to-month lease whereas firms do one-year or longer leases with several pages. Why the difference? Well, if you can’t vet tenants very well and the eviction process is daunting, just rent month-to-month in case you have to give your tenant notice to move out. It’s a crutch.

A pro is continually updating the lease as conditions warrant. Here at River Region Rentals, our standard lease evolves quarterly and is now up to around 14 pages printed. (I say ‘printed’ because we typically do our leasing online for the ease of everyone involved). It’s not a question of ‘who has the longest lease’ but of who has lived it, been burned by it, and has tweaked the lease to avoid that *ever* happening again. Experience creates a long lease.

And speaking of leasing, who wants to deal with a tenant who can give 30 days notice and disappear like a puff of vapor in November, leaving you with a house impossible to rent until Spring? Not me! Avoid month-to-month unless you are keeping that tenant around until you can lock them up with a real lease come spring. That way when it expires NEXT spring you will have a vacancy when you can rent again right away.

The next factor is legal liability. State and Federal law often require strict phrasing in leases. One error on the lease and things can really go sideways in a hurry. One common example is a lease for a home built prior to 1978 has to have materials attached discussing the possible presence of lead paint. If not, you can get slapped with a $10,000 Federal fine, and possibly sued out of existence. Don’t be caught flat-footed because you don’t know how to write a lease. Proper leases really come to the fore during disputes and evictions as well.

I was once at an office supply store where I saw a whole display of boiler-plate leases, applications, etc for ‘self-managers’ for sale. I was dumb-struck. Who would risk an asset with the value of a HOUSE using these materials? Someone willing to take big risks in my opinion.

Conclusion: Self-managers are at a distinct disadvantage here, and it can cost them thousands in vacancy losses, property damage, and even civil fines and penalties.

Liability/Legal/Collections/EvictionsLiability: It’s not uncommon for tenants to pull various scams such as sub-letting, or setting up a property owner for various legal claims. The sad state of affairs is that even the strongest of leases might not provide protection given the creativity of the claim and the inclinations of a judge. Most of our investor clients form an LLC, put their properties in the LLC as assets, and then hire us to manage the property. All of our accounting then interacts with the LLC and not the property owner. In the state of Alabama, forming an LLC is very easy to do on your own and typically costs around $50 to form and $100 (plus revenue taxes) per a year.

In this way, they have created a double fire-wall. First, us as a management company, and then the LLC, as a backstop. They have very limited personal liability in this way. A self-manager has no insulation against legal claims brought against them by a tenant. Nor may they be aware of various scams until they occur to them.

Evictions:

The final area to consider are evictions. No matter how carefully you vet tenants, sooner or later you are going to have to go through an eviction. This in fact is one area where we get lots of clients. They self-manage for years, and then a disaster happens, and they need help getting the tenant out. We’ve even been hired multiple times just to help a property owner evict tenants without managing the property.

There are a few things to consider with regard to evictions. While a property manager may know the eviction process very well, State law may require the firm to use a lawyer. That’s the case here in Alabama, and it usually costs us about $500 in legal fees that we pass on to the property owner. A self-manager in this state can avoid those fees if they navigate the courts themselves, and we know several individuals that have done so. It may take longer, and be a significant time sink, but you can do it.

Conclusion: If legal liability is a concern (and it should be), hire a property management firm. Consider putting your rental assets in an LLC or other legal construction.

If you are going to self-manage, recognize that you also have to invest the time to learn about your State’s landlord-tenant law and that you may have to determine a way to recover monies owed from a delinquent tenant that moves or abandons the property. Consider vetting tenants carefully to avoid deadbeat tenants.

As to evictions, you may save money on your own, but you are going to spend several hours learning the process, attending days of court, drawing up letters to the court, and waiting several weeks for justice to occur. You will also have to document damages and gather quotations for a damages hearing. Consider minimizing your exposure to evictions in the first place.

Yes, we can tell you who all the lousy AC contractors, plumbers, and painters are. Because at one time or another we tried them all out. In the main we use people that give us good prices and good quality work because we give them hundreds of jobs per year.

But if you have any questions about where the rubber hits the road, wait till inclement weather hits. Terrific heat wave. Hard freeze. Windstorm. All those vendors that we call to work on AC units, or broken pipes, or clean up fallen trees, put us at the front of the pack. We get stuff fixed snappy fast because we are a priority customer that pays weekly and has never bounced a check in the history of the company. We do that because we value our contractors and we want them to value us.

Lastly consider strategy. Our goal is maintaining the property, not maximizing monthly income. We want your $75,000 house to STAY a $75,000 house- or even appreciate in value. We don’t want to jeopardize that value by skimping on cheap repairs to send you a bigger rent check. That doesn’t mean we don’t care about the cost -because we absolutely do- but we keep our goals sighted on long-term value. You don’t want to jeopardize the asset to save a few bucks. Keep in your mind’s eye you are playing the long game, and the asset drives the monthly income. It’s important to have a clear view of what your goal is, and that is a stable asset value with ability to sustain monthly income year after year.

Conclusion: Unless you have a sizable portfolio of 100+ houses, or own your maintenance firm, it will be very difficult to compete with a competent property management firm in terms of response time, price of repair, or liability. Viewpoint is critical when evaluating repair costs.

But if you need convincing, wait until you get the bill from your accountant or spend hours tallying everything up on the various tax forms. Cause a competent management firm will send 1099’s to your repair and remodeling vendors and send you tax statements with everything itemized, with receipts etc. Who on earth WANTS to wade through all this paper when it’s a tax write-off anyway? Don’t let that person be you.

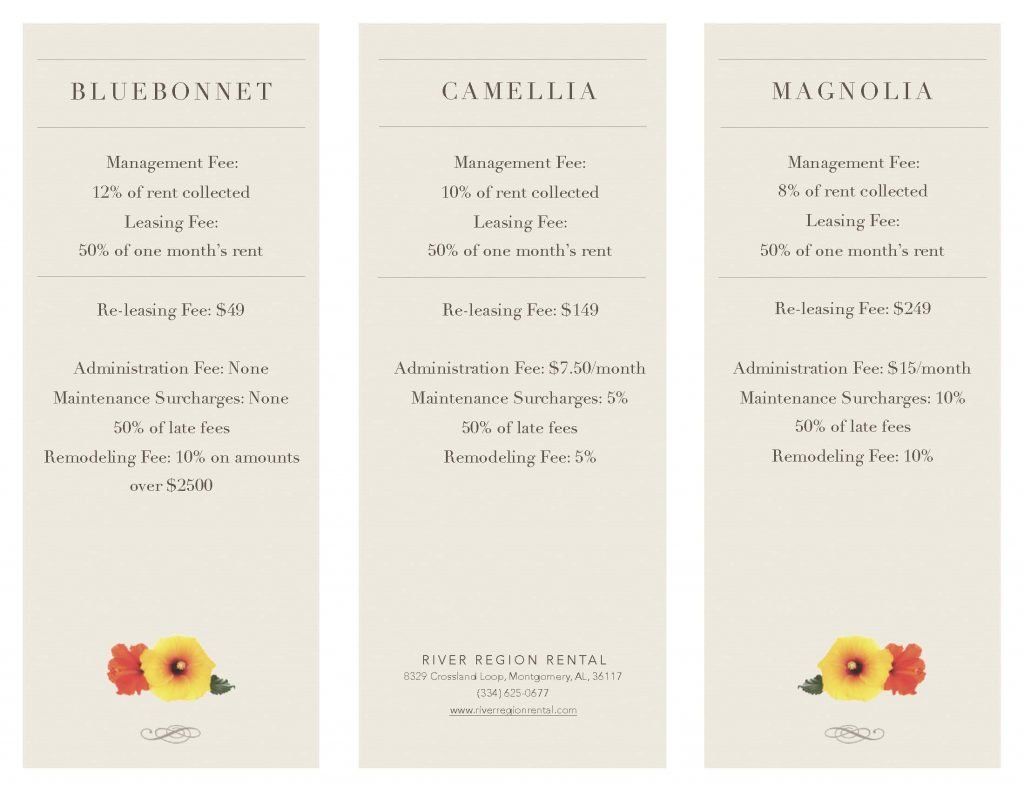

So you spent all this time buying a sign, figuring out a rental cost, placing ads, answering phones, showing potential tenants, checking references, writing leases, studying landlord-tenant law, cashing checks, answering midnight calls about repairs, finding contractors, etc. Did you have vacancy costs? Get the best costs on those repairs? What is your time really worth? On a $900 a month rent you could have just paid $90, pocketed $810, and wrote off the expense on your taxes anyway.

And how much do you like getting sued or handling an eviction? Or hearing excuses about how their mom had a new boyfriend who stole their car and rent will be late for…forever…BUT THEY GOT NOWHERE TO GO!?!

Conclusion: From an expense standpoint, it’s often cheaper to just hire a pro, avoid all the liabilities, and just sleep well at night.